- 3-Minute Article

- |

- Oct 25, 2019

What to Know About Bull and Bear Markets and Your Plans for Retirement

Understanding market types can help you avoid common mistakes.

- What is the difference between a bear market and a bull market?

- What should I know about current market conditions?

- What strategies can I put in place now for a future downturn?

At some point in the last decade, you have likely heard the term “bull market.” It refers to the generally positive performance and upward price trajectory of the stock market, in this case, since 2009. There have been several bull markets, but the current one is considered unusual because of its duration. In fact, this is the longest bull market in history.1 Its opposite is a “bear market,” which is characterized by sustained negative performance of the stock market. The last bear market in the U.S. was the 2007-2009 financial crisis.2

While a bull market is generally good for investors, it’s helpful to understand a few things about these market conditions:

1. Both bull and bear market types are normal parts of the cyclical nature of the economy. Although past performance doesn’t necessarily equate to future results, over the long term, the stock market has historically posted a positive return. 2

2. Market performance is only one indicator of economic health. Other vital signs include things like GDP (gross domestic product), employment rate, and interest rates. Taken together, economic indicators paint a picture of the status of the economy and can provide insight for both businesses and individuals to make financial decisions.

Interest rates, for instance, have been relatively low for several years, which means some types of investments are earning interest more slowly than during periods with higher rates. Therefore, investors may funnel more money into the stock market for the prospect of better returns.

3. Just because the bull market is aging doesn’t necessarily mean we are overdue for a bear market. No one knows what the market will do, but it is sensible to work with your financial advisor to create a plan that manages for known potential risks – including a drop in the markets – and put strategies in place to help ensure the plans you have for retirement aren’t reliant on the capriciousness of market swings.

While you cannot predict what market conditions will be in the future, here are some strategies to discuss with your financial advisor that may make sense for any market conditions:

1. Diversify

Diversification means having a variety of investment types in your portfolio to reduce overall risk because different investment types come with different risks that, when mixed, can help balance each other out. Not putting all your eggs in one investment basket may result in you underperforming a bull market, because inherent to a diversified plan is that some of your assets are not exposed to the market so they wouldn’t capture gains. However, those same assets also wouldn’t suffer losses when the market takes a downward turn.

People facing retirement may seek to diversify with products that offer things like guaranteed income streams or built-in protections from market loss. This can come from products such as a variable annuity with an optional guaranteed income rider or an index-linked annuity that can buffer against loss.

2. Think long term

In times of volatility, it can be tempting to make changes to your portfolio just to feel like you’ve done something. This doesn’t always work in an investors’ favor, however; emotion-driven reactions to temporary volatility can result in missing out on future gains when the market settles.

One tactic could be simply not looking at your portfolio every day. Riding the emotional highs and lows when the markets move won’t change the outcome, but it could change your performance if it triggers you to make a short-sighted change.

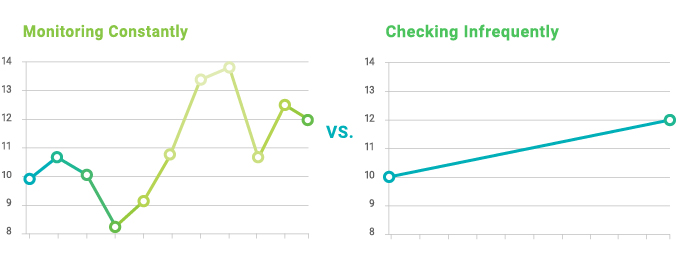

How often you look at your portfolio's performance can impact how volatile it seems to you.

The perception of performance can be different based on whether you monitor the same portfolio either constantly or infrequently.

Speak with your advisor about setting up a ‘pre-commitment’ plan, where you commit to making certain portfolio adjustments under specific market conditions as opposed to on a whim. Having this plan in place can help you stay on track when you’re tempted to make changes.

3. Know what you can control

Markets are unpredictable, so focus on things you can control, such as setting up your plan, working with your advisor to keep your strategy on track, and adopting research-based behaviors that can help you get closer to your goals.